This resource defines how capital assets are accounted for at the university and provides examples of how to view capital assets on Oracle Business Intelligence (OBI) Expenditure Detail and Fund Statement reports.

At Stanford, capital assets are not owned by individual departments but rather by the university as a whole, and are held in a central asset fund. In effect, when a fund purchases a capital asset it "contributes" the asset to the university. While there is an expenditure from the purchasing fund, it is not an expense to the university - it is the purchase of an asset.

In Oracle Financials, capital expenditures are charged to one of several 531xx expenditure types.

- On OBI Consolidated Expenditure Reports (CER), these charges appear in the expected 531xx expenditure type for the PTA that made the purchase.

- On OBI Revenue and Fund Management (RFM) Fund Reports they are reflected as a fund transfer (the contribution of the asset purchased to the central asset fund). Funds are transferred using the General Ledger (GL) object code 49190 - Trans Equip To Plant.

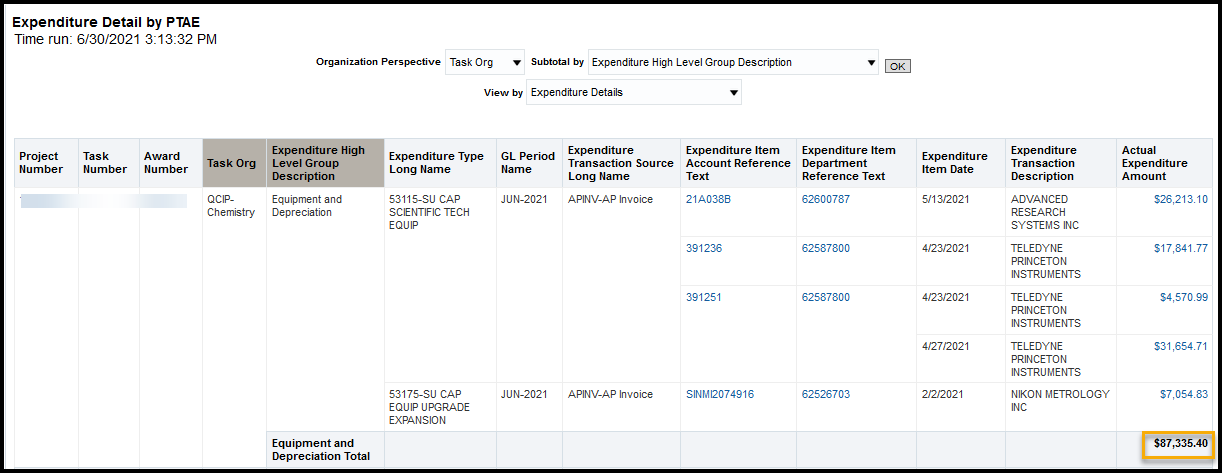

On the OBI CER Expenditure Details report, the purchase of a capital asset appears as an expenditure and the fund (PTA) is charged with the appropriate 531XX expenditure type.

In the example below there were multiple capital expenditures totaling $87,335.40 that occurred during June 2021, using the expenditure types 53115 and 53175.

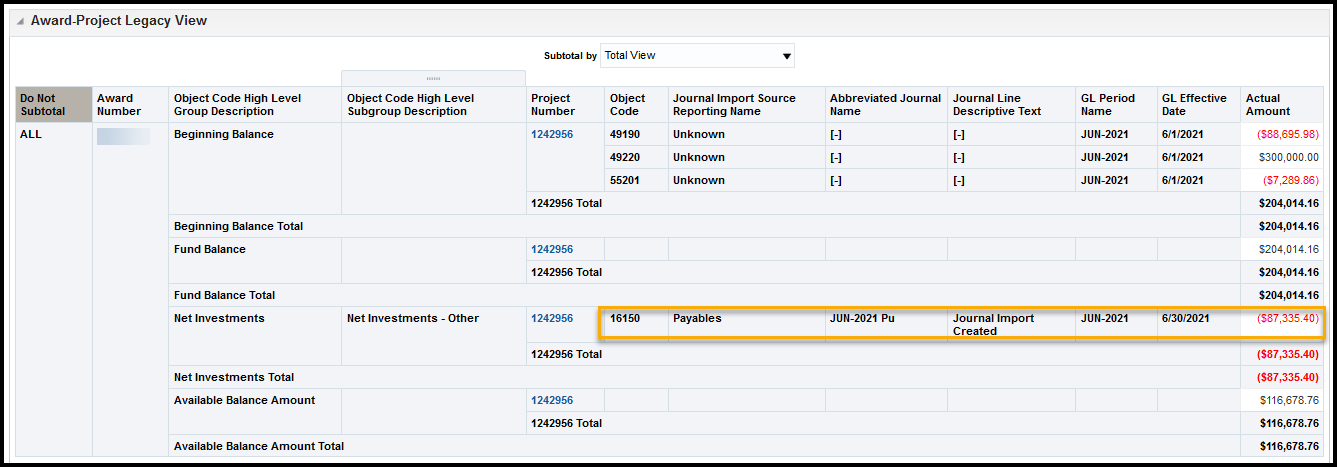

On Fund Statement reports, the same capital asset purchase will initially appear in the Net Investments section with object code 16150- Asset Cost Clearing. The Net Investments balance is deducted from the Fund Balance, which determines the Available Balance. At month-end, the asset purchase amount will ultimately appear in Transfers Out using object code 49190-Trans Equip to Plant, reflecting the fact that the asset has been contributed to the central asset fund.

In the example below, in the month that the capital assets totaling $87,335.40 are invoiced, the item(s) initially appear as assets within Net Investments on the OBI RFM Fund Statement report as object code 16150- Asset Cost Clearing. The inclusion of the assets (which really belong to the university) causes the fund balance to be overstated until the transfer to the central fund is completed at the end of the month.

The asset expense is deducted from the Fund Balance to determine the Available Balance amount (i.e. $204,014.16 – $87,335.40 = $116,678.76).

During month-end close processing, a transfer is made by Financial Management Services (FMS) Capital Accounting. The assets are transferred out as 49190-Trans Equip to Plant to the central asset fund (XZZZZ) and the Fund Balance is reduced accordingly as shown below.

Because the purchase is reflected as a transfer (rather than an expense) on the Fund Statement report, the total expenses on the report will not equal the total expenditures on a corresponding Expenditure Detail report.

- On Expenditure Detail reports, the purchase of a capital asset appears as an expenditure (expenditure type 531xx), reflecting the fact that the fund has been used for that purpose.

- Fund Statement reports, the purchase will appear as a transfer, reflecting the fact that the funds have been used for this purchase and the asset has been contributed to the central asset fund.