Expense Reports are used to report business and travel expenses (including Travel Card and receipt-based expenses) for the purpose of expense approval, and the allocation of expenses to the appropriate Project, Task, Award, and Expenditure Type (PTAE). An expense report may also result in a reimbursement to the Payee for eligible out-of-pocket expenses.

Create Expense Report for Domestic Visitor Expense Reimbursement

Before You Start

- Enter ofweb.stanford.edu in the browser

- Click Login

- As prompted, log in using SUNet ID and password

- Select SU Expense Requests

- Select Non-SU Payee under Expense Report in the Create New Transaction column

- Select Expenses (Domestic) Non-SU from the Category drop-down list

- Enter the Payee's name (last name, first name, or business name)

- Or search and select the payee by clicking the search icon (magnifying glass)

- Select Add New Payee to enter payee information

- Select Supplier or Visitor

- Select the radio button next to the correct Citizenship/Residence status

- Enter First Name and Last Name (Middle Name is optional)

- Select Country of Address

- Enter Address Line 1 (Address Line 2 is optional)

- Enter City

- Select State/Province if required

- Enter Postal/Zip Code if required

- Select Default Payment Method

- To request payment by check, wire or foreign draft, select Check or Wire

- To request payment by ACH/direct deposit to US bank, select Electronic

- Enter Payee /Agent Email

- Email address will auto-populate with the name of preparer if the Country of Address is outside of U.S.

- Enter payee email address if payee is a domestic visitor

- Click Apply to save new payee data Click Clear to delete all entered payee data.

The Payment Method is auto-filled based upon what the Stanford payee has set up (Electronic or Check) with Payroll. If both Electronic and Check are available for a payee (as for some DAPER staff), select preferred method from the drop down.

- Select Yes or No in the Rush Processing drop-down menu

Will Call Check > Rush Processing

Will Call check delivery option is handled via rush processing. Select Yes in the Rush Processing field. The Will Call locations will then display as the check delivery options. Select the Will Call location where the check will be picked up. A $35 processing fee will apply.

On the Allocations and Approvers page, supply a PTA to which the $35 processing fee will be charged. Some PTAs are restricted (sponsored projects) and will not allow a processing fee to be charged to them (Awards that begin with P, Q, R, S, R, U, V, W). Check with the PTA approver or the department Financial Analyst before requesting a rush processing fee. - Select a Check Delivery Option (available when the payment method is Check)

The Payment Method is auto-filled based upon what the payee has setup (Electronic or Check).

- Select Special Payment Type and Delivery Options (optional) if one of the following is desired:

- Foreign Draft

- Wire Domestic

- Wire Foreign

- Enter Business Purpose

- Review Guidelines for Writing a Clear Business Purpose to ensure the business purpose meets requirements.

- Select Event Name from the drop-down menu or, If a new event is needed, select Create New Event (refer to How To: Create New Event for details). To display the selected event details below the Event Name field, select Show Event

- Select Next

On the Transaction Lines screen, note the three available tabs:

- Transaction Lines – use this tab to report cash and personal credit card expenses

- Start with step d for each expense type if you are pasting expense lines from Excel. Refer to How To: Copy and Paste Expense Lines from Excel for instructions and downloadable Excel templates.

- Per Diem Expenses – not allowed for Non-SU Payees

- Mileage Expenses – use this tab to report Mileage expenses

Be sure you are on the tab appropriate for the expenses being reported.

Select expense types that apply to your expenses to see customized instructions:

- The Ground Transportation expense type is for transportation expenses such as taxi, limousine, Uber, and car service, etc. Use other transportation expense types for airfare, car rental or truck rental, fuel for car or truck rental.

- Refer to Policy: Ground Transportation for more information.

- Select Ground Transportation from Expense Type drop-down list

- Optionally, enter a description of transportation in the Remarks field

- If no receipt will be submitted with the expense report:

Missing Original Receipt

Receipts are required for all expenses of $75 or more, or according to departmental guidelines (some departments require receipts for all expenses). If a required receipt is missing or lost, a copy must be requested from the merchant. If a copy cannot be obtained from the merchant, continue with the following steps:

1. Select Details icon

2. Select Original Receipt Missing checkbox

3. Provide an explanation in Remarks field

4. Select Return to List

- The Parking Fees Expense Type is used when a Stanford employee travels for business and has expenses for parking. This does not include regular, employee, commute costs for parking at Stanford which are not reimbursable.

- Select Parking Fees from Expense Type drop-down list

- Optionally, enter a description of the parking fees in the Remarks field

- If no receipt will be submitted with the expense report:

Missing Original Receipt

Receipts are required for all expenses of $75 or more, or according to departmental guidelines (some departments require receipts for all expenses). If a required receipt is missing or lost, a copy must be requested from the merchant. If a copy cannot be obtained from the merchant, continue with the following steps:

1. Select Details icon

2. Select Original Receipt Missing checkbox

3. Provide an explanation in Remarks field

4. Select Return to List

- If the expense included other business or personal expenses, itemize expenses:

Itemize Expenses

1. Select Details

2. Select Itemize

3. Change the Itemized Receipt Amount field to the dollar amount of the business portion of the expense

4. Enter description in the Remarks

5. Select Add Another Row and repeat the process to itemize other business portions of the expense

6. Select Return to List

Any remaining amount not put on an itemized line will show as Personal Expenses.

Designate PTAEs on Allocations and Approvers screen using any combination of these 3 options:

- Enter Project, Task, Award information for each line

- Select Expenditure Type for each line A commonly used expenditure type may appear. If the field is blank, select from the drop-down list.

- Select the radio button to select one, multiple or all expense lines

- Select one of the pre-set expense allocations from My Allocation drop-down list Refer to How To: Set My Allocation Preferences for more information.

- Select Apply

- Verify that the desired expenditure type has been applied to each expense line before submitting the transaction – correct as needed using the drop-down list

- To enter a new PTA (not in My Allocations) and allocate to one, multiple or all expense lines and/or

- To enter a split PTA allocation and allocate to one, multiple or all expense lines

- Select the radio button to select expense lines to be allocated

- Select Update Allocation

- Select an Allocation Method

- Mass Allocation or Single PTA

- Equal Split

- Amount Split

- Percentage Split

- Select the plus sign on table to add a new row for each PTA for a split allocation

- Enter the Project, Task, Award information (PTAs)

- Enter Amount or Percentage of split for each PTA, if necessary

- Enter Allocation Reason to describe the reason for allocation to multiple PTAs (optional) Save Allocation in My Allocation Preferences

You may save this allocation in your My Allocation Preferences for use again.

1. Select Add Allocation Set to My Allocations checkbox

2. Enter the Allocation Name - Select Apply

- Select Expenditure Type for each line A commonly used expenditure type may appear. If the field is blank, select from the drop-down list.

Designate approver(s) on Allocations and Approvers screen using any combination of these 3 options:

- Select one of the pre-set approvers from My Approvers drop-down list

- Select Apply

- Enter the approver's sequence or send in parallel (enter 1, 2, 3 for sequence; assign all approver's "1" for in parallel routing)

- Enter Notes to each approver (if needed)

- Select Next when the Approver Routing List is complete

FYI Recipients do not "approve" the expense report.

If an approver has been deleted by mistake, select Populate/Refresh to return to original default approver.

If an approver is incorrect for a PTA, please have that approver submit a Support Request to have the authority updated.

- Select Populate/Refresh to add default PTA approver(s)

Approvers that display when Populate/Refresh is selected will have the appropriate approval authority for the PTAs. If expense lines have been allocated to more than one PTA, there could be more than one approver showing in the approver routing list. - Enter the approver's sequence or send in parallel (enter 1, 2, 3 for sequence; assign all approver's "1" for in parallel routing)

- Enter Notes to each approver (if needed)

- Select Next when the Approver Routing List is complete

FYI Recipients do not "approve" the expense report.

If an approver has been deleted by mistake, select Populate/Refresh to return to original default approver.

If an approver is incorrect for a PTA, please have that approver submit a Support Request to have the authority updated.

- Select the plus sign on table to add an approver

- Select the magnifying glass icon

- Enter the approver's name (Last name, First name)

- Select Go

- Select Quick Select icon next to the approver's name

- Select Approver, FYI or Pre-Approver from Approver/FYI drop-down list

- Enter the Approval Sequence number (enter 1, 2, 3 for sequence; assign all approver's “1” for in parallel routing, assign Pre-Approvers 1).

- Enter Notes to each approver (if needed)

- Select Next when the Approver Routing List is complete

FYI Recipients and Pre-Approvers do not "approve" the expense report, but will receive notifications regarding the transaction.

If an approver has been deleted by mistake, select Populate/Refresh to return to original default approver. There must be a "Yes" displaying in the default approver column for at least one approver per PTA.

If an approver is incorrect for a PTA, please have that approver submit a Support Request to have the authority updated.

All expense reports must include receipts and other supporting documentation. If an expense has been pre-approved, supporting documentation must be obtained from the Pre-Approver and attached to the expense line or to the transaction.

An attachment for Expense Requests and PCard Transactions must be a legible copy of the entire receipt and clearly show:

- All text

- Receipt Date

- Location (when available)

- Vendor/Business Name

- Entire Receipt (Additional screenshots may be needed to include all of a lengthy receipt.

Use the Event/Reason to capture the reason and add pg. 1, pg. 2, etc. to clarify.)

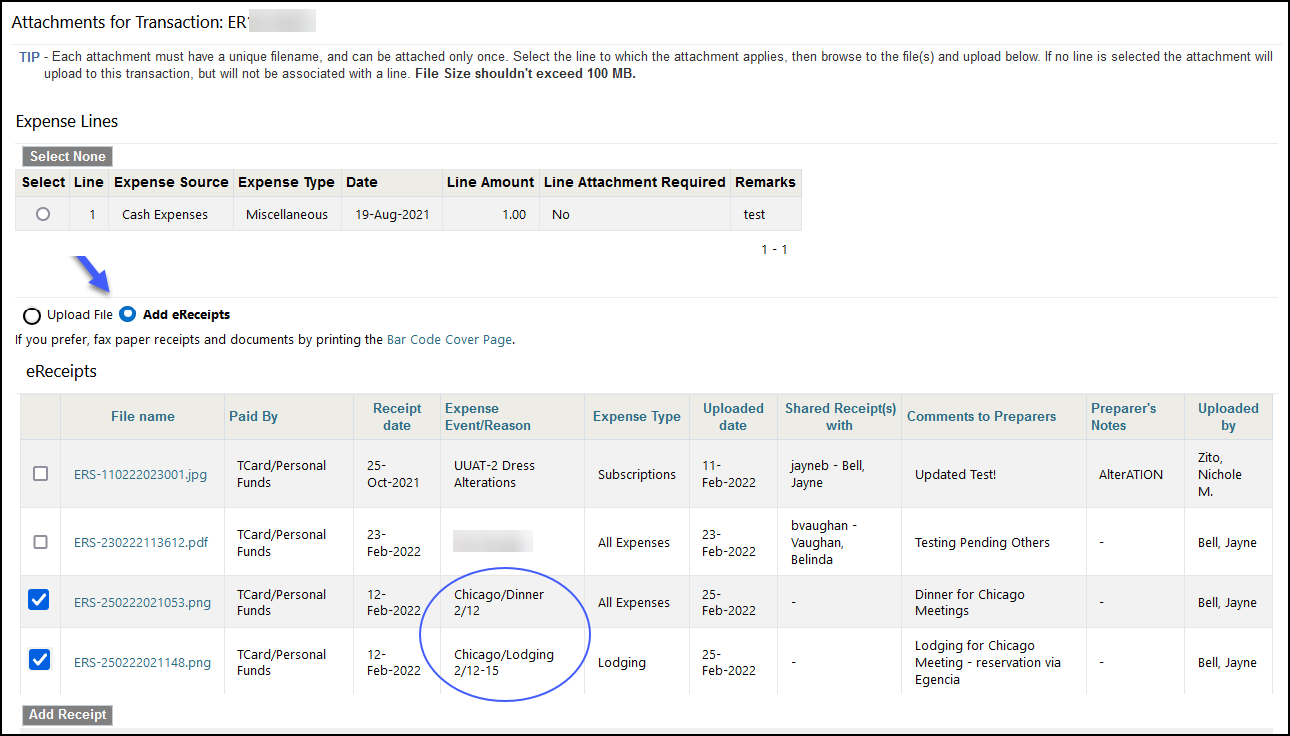

You can upload an image directly to the transaction, add attachments via the eReceipts application or fax the document using a BarCode Cover Sheet.

Expense reports must have attachments uploaded to the individual transaction line for Airfare, Lodging and Conference Registration.

- Scan or use a smartphone to photograph required receipts and documents to be attached to the transaction into a file

- Name each file with a unique name and save on the computer Allowed file formats include .pdf, .jpg, .png, .doc, .docx, .xls, .xlsx.

- Select green plus sign (if available)

- Select Browse to navigate to file

- Select file

- Select Open

- Repeat until all files for the line are in Files ready to upload

- Select Upload file(s) File(s) will appear in View Attachments.

- Select Close

- Green plus sign changes to paper clip to indicate file(s) attached

- Green plus sign changes to paper clip to indicate file(s) attached

- Scan or use a smartphone to photograph required receipts and documents to be attached to the transaction into a file

- Name each file with a unique name and save on the computer Allowed file formats include .pdf, .jpg, .png, .doc, .docx, .xls, .xlsx.

- Select Attach/View Receipts button to open the Attachments window

- Do Not select a line

- Select Browse to navigate to file

- Select file

- Select Open

- Repeat until all files are in Files ready to upload

- Select Upload file(s) File(s) will appear in View Attachments.

- Files attached to the transaction display N/A in the Expense Source and For Transaction Line(s) columns

- Select Close to close the Attachments window

Reassign Attachments to a Line (if required)

1. Click Attach/View Receipts button to open the Attachments window

2. Scroll down and select the Reassign icon for the attachment

3. Select the Document Type

4. Select the line to which the attachment is to be reassigned

5. Click Save

6. Repeat for all uploaded attachments that must be reassigned to a line

- Select Attach/View Receipts on the Transaction Review screen

- Select Add eReceipts to view all eReceipts shared with you for that Category (PCard or TCard/Personal Funds)

- Select the correct receipt(s) associated with the transaction

- Click Add Receipt button at the bottom

- Select Attach/View Receipts on the Transaction Review screen

- Select Bar Code Cover Page on the Attach/View Receipts window and print Faxed receipts and documents must include the Barcode Cover Sheet to attach to the transaction.

The fax number (650-721-3072) is on the Barcode Cover Sheet page. - Close the Bar Code Cover Page window

- Send an individual fax for each line that requires an attachment

- Send a fax containing all other receipts and documents The Bar Code Cover Page should be the first page of the Fax so that it attaches to the correct transaction.

- Select Attach/View Receipts to open the Attachments window Faxes will display in the View Attachments section, attached at the transaction level.

- Select Close to close the Attachments window

Reassign Attachments to a Line (if required)

1. Click Attach/View Receipts button to open the Attachments window

2. Scroll down and select the Reassign icon for the attachment

3. Select the Document Type

4. Select the line to which the attachment is to be reassigned

5. Click Save

6. Repeat for all uploaded attachments that must be reassigned to a line

- Review the transaction carefully for completeness, accuracy and policy compliance.

- Refer to the tabs marked Expense Lines, Expense Allocations, Approvers and Approval Notes for additional information.

- Use the Back button, if necessary, to return to previous pages for corrections.

- If this expense report contains expenses that exceed 60 days, select the *Delay Reason from the drop down below for the late expense.

- If Other is selected, please explain the reason for the late submission in the “Please Explain” field.

- Check the box attesting that the Beneficiary Information is accurate and that supporting documentation will be attached.

- Attach all receipts and backup documentation (Received of Petty Cash Form if required) by selecting Attach View Receipts or the Attach icon for a specific expense line

- Select Submit to submit the transaction once all receipts and backup documents have been attached

Create Expense Report for Human Subject Expense Reimbursement

Before You Start

Human Subjects Non-SU is to request reimbursement for domestic travel expenses for a human subject participant

- Enter ofweb.stanford.edu in the browser

- Click Login

- As prompted, log in using SUNet ID and password

- Select SU Expense Requests

- Select Non-SU Payee under Expense Report in the Create New Transaction column

- Select Human Subjects Non-SU from the Category drop-down list

- Enter the Payee's name (last name, first name, or business name)

- Or search and select the payee by clicking the search icon (magnifying glass)

- Select Add New Payee to enter payee information

- Select Supplier or Visitor

- Select the radio button next to the correct Citizenship/Residence status

- Enter First Name and Last Name (Middle Name is optional)

- Select Country of Address

- Enter Address Line 1 (Address Line 2 is optional)

- Enter City

- Select State/Province if required

- Enter Postal/Zip Code if required

- Select Default Payment Method

- To request payment by check, wire or foreign draft, select Check or Wire

- To request payment by ACH/direct deposit to US bank, select Electronic

- Enter Payee /Agent Email

- Email address will auto-populate with the name of preparer if the Country of Address is outside of U.S.

- Enter payee email address if payee is a domestic visitor

- Click Apply to save new payee data Click Clear to delete all entered payee data.

The Payment Method is auto-filled based upon what the Stanford payee has set up (Electronic or Check) with Payroll. If both Electronic and Check are available for a payee (as for some DAPER staff), select preferred method from the drop down.

- Select Yes or No in the Rush Processing drop-down menu

Will Call Check > Rush Processing

Will Call check delivery option is handled via rush processing. Select Yes in the Rush Processing field. The Will Call locations will then display as the check delivery options. Select the Will Call location where the check will be picked up. A $35 processing fee will apply.

On the Allocations and Approvers page, supply a PTA to which the $35 processing fee will be charged. Some PTAs are restricted (sponsored projects) and will not allow a processing fee to be charged to them (Awards that begin with P, Q, R, S, R, U, V, W). Check with the PTA approver or the department Financial Analyst before requesting a rush processing fee. - Select a Check Delivery Option (available when the payment method is Check)

The Payment Method is auto-filled based upon what the payee has setup (Electronic or Check).

- Select Special Payment Type and Delivery Options (optional) if one of the following is desired:

- Foreign Draft

- Wire Domestic

- Wire Foreign

- Enter Business Purpose

- Review Guidelines for Writing a Clear Business Purpose to ensure the business purpose meets requirements.

- Select Event Name from the drop-down menu or, If a new event is needed, select Create New Event (refer to How To: Create New Event for details). To display the selected event details below the Event Name field, select Show Event

- Select Next

On the Transaction Lines screen, note the three available tabs:

- Transaction Lines – use this tab to report cash and personal credit card expenses

- Start with step d for each expense type if you are pasting expense lines from Excel. Refer to How To: Copy and Paste Expense Lines from Excel for instructions and downloadable Excel templates.

- Per Diem Expenses – not allowed for Non-SU Payees

- Mileage Expenses – use this tab to report Mileage expenses

Be sure you are on the tab appropriate for the expenses being reported.

Select expense types that apply to your expenses to see customized instructions:

- The Ground Transportation expense type is for transportation expenses such as taxi, limousine, Uber, and car service, etc. Use other transportation expense types for airfare, car rental or truck rental, fuel for car or truck rental.

- Refer to Policy: Ground Transportation for more information.

- Select Ground Transportation from Expense Type drop-down list

- Optionally, enter a description of transportation in the Remarks field

- If no receipt will be submitted with the expense report:

Missing Original Receipt

Receipts are required for all expenses of $75 or more, or according to departmental guidelines (some departments require receipts for all expenses). If a required receipt is missing or lost, a copy must be requested from the merchant. If a copy cannot be obtained from the merchant, continue with the following steps:

1. Select Details icon

2. Select Original Receipt Missing checkbox

3. Provide an explanation in Remarks field

4. Select Return to List

- The Parking Fees Expense Type is used when a Stanford employee travels for business and has expenses for parking. This does not include regular, employee, commute costs for parking at Stanford which are not reimbursable.

- Select Parking Fees from Expense Type drop-down list

- Optionally, enter a description of the parking fees in the Remarks field

- If no receipt will be submitted with the expense report:

Missing Original Receipt

Receipts are required for all expenses of $75 or more, or according to departmental guidelines (some departments require receipts for all expenses). If a required receipt is missing or lost, a copy must be requested from the merchant. If a copy cannot be obtained from the merchant, continue with the following steps:

1. Select Details icon

2. Select Original Receipt Missing checkbox

3. Provide an explanation in Remarks field

4. Select Return to List

- If the expense included other business or personal expenses, itemize expenses:

Itemize Expenses

1. Select Details

2. Select Itemize

3. Change the Itemized Receipt Amount field to the dollar amount of the business portion of the expense

4. Enter description in the Remarks

5. Select Add Another Row and repeat the process to itemize other business portions of the expense

6. Select Return to List

Any remaining amount not put on an itemized line will show as Personal Expenses.

Designate PTAEs on Allocations and Approvers screen using any combination of these 3 options:

- Enter Project, Task, Award information for each line

- Select Expenditure Type for each line A commonly used expenditure type may appear. If the field is blank, select from the drop-down list.

- Select the radio button to select one, multiple or all expense lines

- Select one of the pre-set expense allocations from My Allocation drop-down list Refer to How To: Set My Allocation Preferences for more information.

- Select Apply

- Verify that the desired expenditure type has been applied to each expense line before submitting the transaction – correct as needed using the drop-down list

- To enter a new PTA (not in My Allocations) and allocate to one, multiple or all expense lines and/or

- To enter a split PTA allocation and allocate to one, multiple or all expense lines

- Select the radio button to select expense lines to be allocated

- Select Update Allocation

- Select an Allocation Method

- Mass Allocation or Single PTA

- Equal Split

- Amount Split

- Percentage Split

- Select the plus sign on table to add a new row for each PTA for a split allocation

- Enter the Project, Task, Award information (PTAs)

- Enter Amount or Percentage of split for each PTA, if necessary

- Enter Allocation Reason to describe the reason for allocation to multiple PTAs (optional) Save Allocation in My Allocation Preferences

You may save this allocation in your My Allocation Preferences for use again.

1. Select Add Allocation Set to My Allocations checkbox

2. Enter the Allocation Name - Select Apply

- Select Expenditure Type for each line A commonly used expenditure type may appear. If the field is blank, select from the drop-down list.

Designate approver(s) on Allocations and Approvers screen using any combination of these 3 options:

- Select one of the pre-set approvers from My Approvers drop-down list

- Select Apply

- Enter the approver's sequence or send in parallel (enter 1, 2, 3 for sequence; assign all approver's "1" for in parallel routing)

- Enter Notes to each approver (if needed)

- Select Next when the Approver Routing List is complete

FYI Recipients do not "approve" the expense report.

If an approver has been deleted by mistake, select Populate/Refresh to return to original default approver.

If an approver is incorrect for a PTA, please have that approver submit a Support Request to have the authority updated.

- Select Populate/Refresh to add default PTA approver(s)

Approvers that display when Populate/Refresh is selected will have the appropriate approval authority for the PTAs. If expense lines have been allocated to more than one PTA, there could be more than one approver showing in the approver routing list. - Enter the approver's sequence or send in parallel (enter 1, 2, 3 for sequence; assign all approver's "1" for in parallel routing)

- Enter Notes to each approver (if needed)

- Select Next when the Approver Routing List is complete

FYI Recipients do not "approve" the expense report.

If an approver has been deleted by mistake, select Populate/Refresh to return to original default approver.

If an approver is incorrect for a PTA, please have that approver submit a Support Request to have the authority updated.

- Select the plus sign on table to add an approver

- Select the magnifying glass icon

- Enter the approver's name (Last name, First name)

- Select Go

- Select Quick Select icon next to the approver's name

- Select Approver, FYI or Pre-Approver from Approver/FYI drop-down list

- Enter the Approval Sequence number (enter 1, 2, 3 for sequence; assign all approver's “1” for in parallel routing, assign Pre-Approvers 1).

- Enter Notes to each approver (if needed)

- Select Next when the Approver Routing List is complete

FYI Recipients and Pre-Approvers do not "approve" the expense report, but will receive notifications regarding the transaction.

If an approver has been deleted by mistake, select Populate/Refresh to return to original default approver. There must be a "Yes" displaying in the default approver column for at least one approver per PTA.

If an approver is incorrect for a PTA, please have that approver submit a Support Request to have the authority updated.

All expense reports must include receipts and other supporting documentation. If an expense has been pre-approved, supporting documentation must be obtained from the Pre-Approver and attached to the expense line or to the transaction.

An attachment for Expense Requests and PCard Transactions must be a legible copy of the entire receipt and clearly show:

- All text

- Receipt Date

- Location (when available)

- Vendor/Business Name

- Entire Receipt (Additional screenshots may be needed to include all of a lengthy receipt.

Use the Event/Reason to capture the reason and add pg. 1, pg. 2, etc. to clarify.)

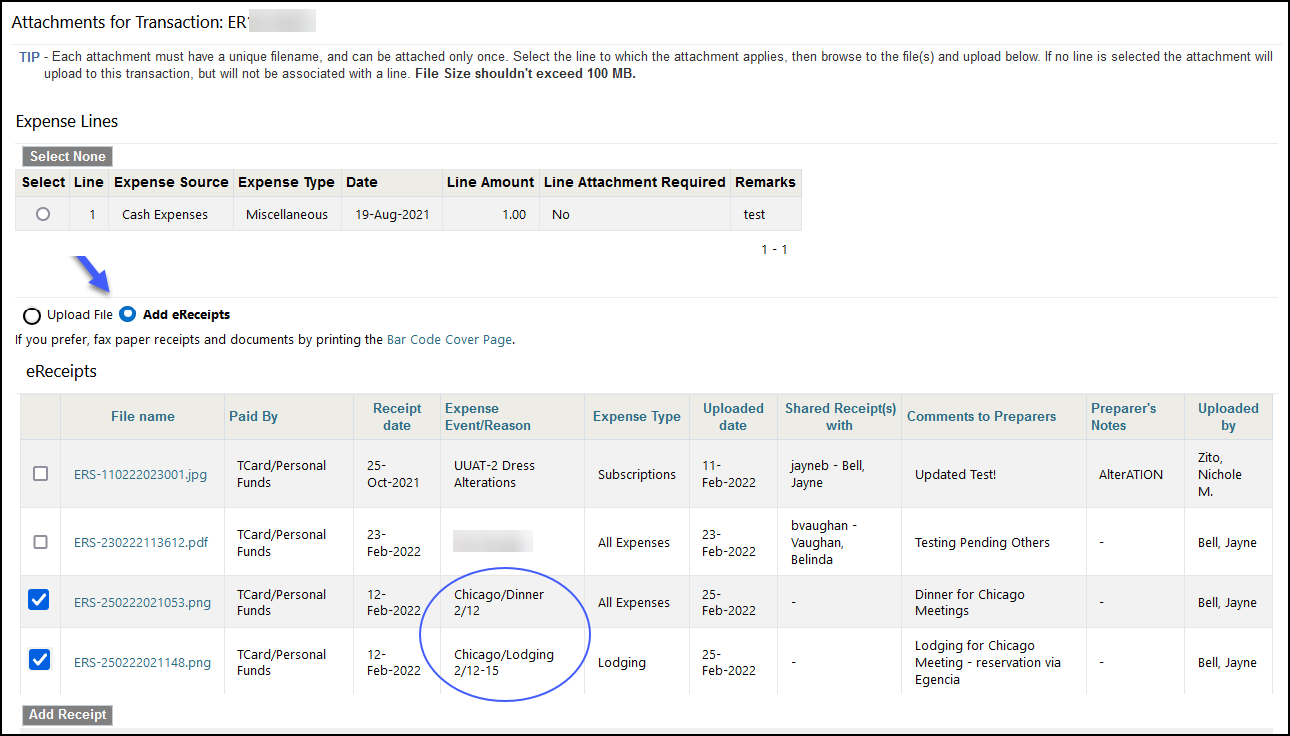

You can upload an image directly to the transaction, add attachments via the eReceipts application or fax the document using a BarCode Cover Sheet.

Expense reports must have attachments uploaded to the individual transaction line for Airfare, Lodging and Conference Registration.

- Scan or use a smartphone to photograph required receipts and documents to be attached to the transaction into a file

- Name each file with a unique name and save on the computer Allowed file formats include .pdf, .jpg, .png, .doc, .docx, .xls, .xlsx.

- Select green plus sign (if available)

- Select Browse to navigate to file

- Select file

- Select Open

- Repeat until all files for the line are in Files ready to upload

- Select Upload file(s) File(s) will appear in View Attachments.

- Select Close

- Green plus sign changes to paper clip to indicate file(s) attached

- Green plus sign changes to paper clip to indicate file(s) attached

- Scan or use a smartphone to photograph required receipts and documents to be attached to the transaction into a file

- Name each file with a unique name and save on the computer Allowed file formats include .pdf, .jpg, .png, .doc, .docx, .xls, .xlsx.

- Select Attach/View Receipts button to open the Attachments window

- Do Not select a line

- Select Browse to navigate to file

- Select file

- Select Open

- Repeat until all files are in Files ready to upload

- Select Upload file(s) File(s) will appear in View Attachments.

- Files attached to the transaction display N/A in the Expense Source and For Transaction Line(s) columns

- Select Close to close the Attachments window

Reassign Attachments to a Line (if required)

1. Click Attach/View Receipts button to open the Attachments window

2. Scroll down and select the Reassign icon for the attachment

3. Select the Document Type

4. Select the line to which the attachment is to be reassigned

5. Click Save

6. Repeat for all uploaded attachments that must be reassigned to a line

- Select Attach/View Receipts on the Transaction Review screen

- Select Add eReceipts to view all eReceipts shared with you for that Category (PCard or TCard/Personal Funds)

- Select the correct receipt(s) associated with the transaction

- Click Add Receipt button at the bottom

- Select Attach/View Receipts on the Transaction Review screen

- Select Bar Code Cover Page on the Attach/View Receipts window and print Faxed receipts and documents must include the Barcode Cover Sheet to attach to the transaction.

The fax number (650-721-3072) is on the Barcode Cover Sheet page. - Close the Bar Code Cover Page window

- Send an individual fax for each line that requires an attachment

- Send a fax containing all other receipts and documents The Bar Code Cover Page should be the first page of the Fax so that it attaches to the correct transaction.

- Select Attach/View Receipts to open the Attachments window Faxes will display in the View Attachments section, attached at the transaction level.

- Select Close to close the Attachments window

Reassign Attachments to a Line (if required)

1. Click Attach/View Receipts button to open the Attachments window

2. Scroll down and select the Reassign icon for the attachment

3. Select the Document Type

4. Select the line to which the attachment is to be reassigned

5. Click Save

6. Repeat for all uploaded attachments that must be reassigned to a line

- Review the transaction carefully for completeness, accuracy and policy compliance.

- Refer to the tabs marked Expense Lines, Expense Allocations, Approvers and Approval Notes for additional information.

- Use the Back button, if necessary, to return to previous pages for corrections.

- Attach all receipts and backup documentation (Received of Petty Cash Form) by selecting Attach View Receipts or the Attach icon for a specific expense line

- Select Submit to submit the transaction once all receipts and backup documents have been attached

Create Expense Report for Foreign Visitor Expense Reimbursement

Before You Start

- Enter ofweb.stanford.edu in the browser

- Click Login

- As prompted, log in using SUNet ID and password

- Select SU Expense Requests

- Select Non-SU Payee under Expense Report in the Create New Transaction column

- Select Expenses (Foreign) Non-SU from the Category drop-down list

- Enter the Payee's name (last name, first name, or business name)

- Or search and select the payee by clicking the search icon (magnifying glass)

- Select Add New Payee to enter payee information

- Select Supplier or Visitor

- Select the radio button next to the correct Citizenship/Residence status

- Enter First Name and Last Name (Middle Name is optional)

- Select Country of Address

- Enter Address Line 1 (Address Line 2 is optional)

- Enter City

- Select State/Province if required

- Enter Postal/Zip Code if required

- Select Default Payment Method

- To request payment by check, wire or foreign draft, select Check or Wire

- To request payment by ACH/direct deposit to US bank, select Electronic

- Enter Payee /Agent Email

- Email address will auto-populate with the name of preparer if the Country of Address is outside of U.S.

- Enter payee email address if payee is a domestic visitor

- Click Apply to save new payee data Click Clear to delete all entered payee data.

The Payment Method is auto-filled based upon what the Stanford payee has set up (Electronic or Check) with Payroll. If both Electronic and Check are available for a payee (as for some DAPER staff), select preferred method from the drop down.

- Select Yes or No in the Rush Processing drop-down menu

Will Call Check > Rush Processing

Will Call check delivery option is handled via rush processing. Select Yes in the Rush Processing field. The Will Call locations will then display as the check delivery options. Select the Will Call location where the check will be picked up. A $35 processing fee will apply.

On the Allocations and Approvers page, supply a PTA to which the $35 processing fee will be charged. Some PTAs are restricted (sponsored projects) and will not allow a processing fee to be charged to them (Awards that begin with P, Q, R, S, R, U, V, W). Check with the PTA approver or the department Financial Analyst before requesting a rush processing fee. - Select a Check Delivery Option (available when the payment method is Check)

The Payment Method is auto-filled based upon what the payee has setup (Electronic or Check).

- Select Special Payment Type and Delivery Options (optional) if one of the following is desired:

- Foreign Draft

- Wire Domestic

- Wire Foreign

- Enter Business Purpose

- Review Guidelines for Writing a Clear Business Purpose to ensure the business purpose meets requirements.

- Select Event Name (mandatory for foreign expense reports) from the drop-down menu or, If a new event is needed, select Create New Event (refer to How To: Create New Event for details). To display the selected event details below the Event Name field, select Show Event

- Select Next

On the Transaction Lines screen, note the three available tabs:

- Transaction Lines – use this tab to report cash and personal credit card expenses

- Start with step d for each expense type if you are pasting expense lines from Excel. Refer to How To: Copy and Paste Expense Lines from Excel for instructions and downloadable Excel templates.

- Per Diem Expenses – not allowed for Non-SU Payees

- Mileage Expenses – use this tab to report Mileage expenses

Be sure you are on the tab appropriate for the expenses being reported.

Select expense types that apply to your expenses to see customized instructions:

- The Ground Transportation expense type is for transportation expenses such as taxi, limousine, Uber, and car service, etc. Use other transportation expense types for airfare, car rental or truck rental, fuel for car or truck rental.

- Refer to Policy: Ground Transportation for more information.

- Select Ground Transportation from Expense Type drop-down list

- Optionally, enter a description of transportation in the Remarks field

- If no receipt will be submitted with the expense report:

Missing Original Receipt

Receipts are required for all expenses of $75 or more, or according to departmental guidelines (some departments require receipts for all expenses). If a required receipt is missing or lost, a copy must be requested from the merchant. If a copy cannot be obtained from the merchant, continue with the following steps:

1. Select Details icon

2. Select Original Receipt Missing checkbox

3. Provide an explanation in Remarks field

4. Select Return to List

- The Parking Fees Expense Type is used when a Stanford employee travels for business and has expenses for parking. This does not include regular, employee, commute costs for parking at Stanford which are not reimbursable.

- Select Parking Fees from Expense Type drop-down list

- Optionally, enter a description of the parking fees in the Remarks field

- If no receipt will be submitted with the expense report:

Missing Original Receipt

Receipts are required for all expenses of $75 or more, or according to departmental guidelines (some departments require receipts for all expenses). If a required receipt is missing or lost, a copy must be requested from the merchant. If a copy cannot be obtained from the merchant, continue with the following steps:

1. Select Details icon

2. Select Original Receipt Missing checkbox

3. Provide an explanation in Remarks field

4. Select Return to List

- If the expense included other business or personal expenses, itemize expenses:

Itemize Expenses

1. Select Details

2. Select Itemize

3. Change the Itemized Receipt Amount field to the dollar amount of the business portion of the expense

4. Enter description in the Remarks

5. Select Add Another Row and repeat the process to itemize other business portions of the expense

6. Select Return to List

Any remaining amount not put on an itemized line will show as Personal Expenses.

Designate PTAEs on Allocations and Approvers screen using any combination of these 3 options:

- Enter Project, Task, Award information for each line

- Select Expenditure Type for each line A commonly used expenditure type may appear. If the field is blank, select from the drop-down list.

- Select the radio button to select one, multiple or all expense lines

- Select one of the pre-set expense allocations from My Allocation drop-down list Refer to How To: Set My Allocation Preferences for more information.

- Select Apply

- Verify that the desired expenditure type has been applied to each expense line before submitting the transaction – correct as needed using the drop-down list

- To enter a new PTA (not in My Allocations) and allocate to one, multiple or all expense lines and/or

- To enter a split PTA allocation and allocate to one, multiple or all expense lines

- Select the radio button to select expense lines to be allocated

- Select Update Allocation

- Select an Allocation Method

- Mass Allocation or Single PTA

- Equal Split

- Amount Split

- Percentage Split

- Select the plus sign on table to add a new row for each PTA for a split allocation

- Enter the Project, Task, Award information (PTAs)

- Enter Amount or Percentage of split for each PTA, if necessary

- Enter Allocation Reason to describe the reason for allocation to multiple PTAs (optional) Save Allocation in My Allocation Preferences

You may save this allocation in your My Allocation Preferences for use again.

1. Select Add Allocation Set to My Allocations checkbox

2. Enter the Allocation Name - Select Apply

- Select Expenditure Type for each line A commonly used expenditure type may appear. If the field is blank, select from the drop-down list.

Designate approver(s) on Allocations and Approvers screen using any combination of these 3 options:

- Select one of the pre-set approvers from My Approvers drop-down list

- Select Apply

- Enter the approver's sequence or send in parallel (enter 1, 2, 3 for sequence; assign all approver's "1" for in parallel routing)

- Enter Notes to each approver (if needed)

- Select Next when the Approver Routing List is complete

FYI Recipients do not "approve" the expense report.

If an approver has been deleted by mistake, select Populate/Refresh to return to original default approver.

If an approver is incorrect for a PTA, please have that approver submit a Support Request to have the authority updated.

- Select Populate/Refresh to add default PTA approver(s)

Approvers that display when Populate/Refresh is selected will have the appropriate approval authority for the PTAs. If expense lines have been allocated to more than one PTA, there could be more than one approver showing in the approver routing list. - Enter the approver's sequence or send in parallel (enter 1, 2, 3 for sequence; assign all approver's "1" for in parallel routing)

- Enter Notes to each approver (if needed)

- Select Next when the Approver Routing List is complete

FYI Recipients do not "approve" the expense report.

If an approver has been deleted by mistake, select Populate/Refresh to return to original default approver.

If an approver is incorrect for a PTA, please have that approver submit a Support Request to have the authority updated.

- Select the plus sign on table to add an approver

- Select the magnifying glass icon

- Enter the approver's name (Last name, First name)

- Select Go

- Select Quick Select icon next to the approver's name

- Select Approver, FYI or Pre-Approver from Approver/FYI drop-down list

- Enter the Approval Sequence number (enter 1, 2, 3 for sequence; assign all approver's “1” for in parallel routing, assign Pre-Approvers 1).

- Enter Notes to each approver (if needed)

- Select Next when the Approver Routing List is complete

FYI Recipients and Pre-Approvers do not "approve" the expense report, but will receive notifications regarding the transaction.

If an approver has been deleted by mistake, select Populate/Refresh to return to original default approver. There must be a "Yes" displaying in the default approver column for at least one approver per PTA.

If an approver is incorrect for a PTA, please have that approver submit a Support Request to have the authority updated.

All expense reports must include receipts and other supporting documentation. If an expense has been pre-approved, supporting documentation must be obtained from the Pre-Approver and attached to the expense line or to the transaction.

An attachment for Expense Requests and PCard Transactions must be a legible copy of the entire receipt and clearly show:

- All text

- Receipt Date

- Location (when available)

- Vendor/Business Name

- Entire Receipt (Additional screenshots may be needed to include all of a lengthy receipt.

Use the Event/Reason to capture the reason and add pg. 1, pg. 2, etc. to clarify.)

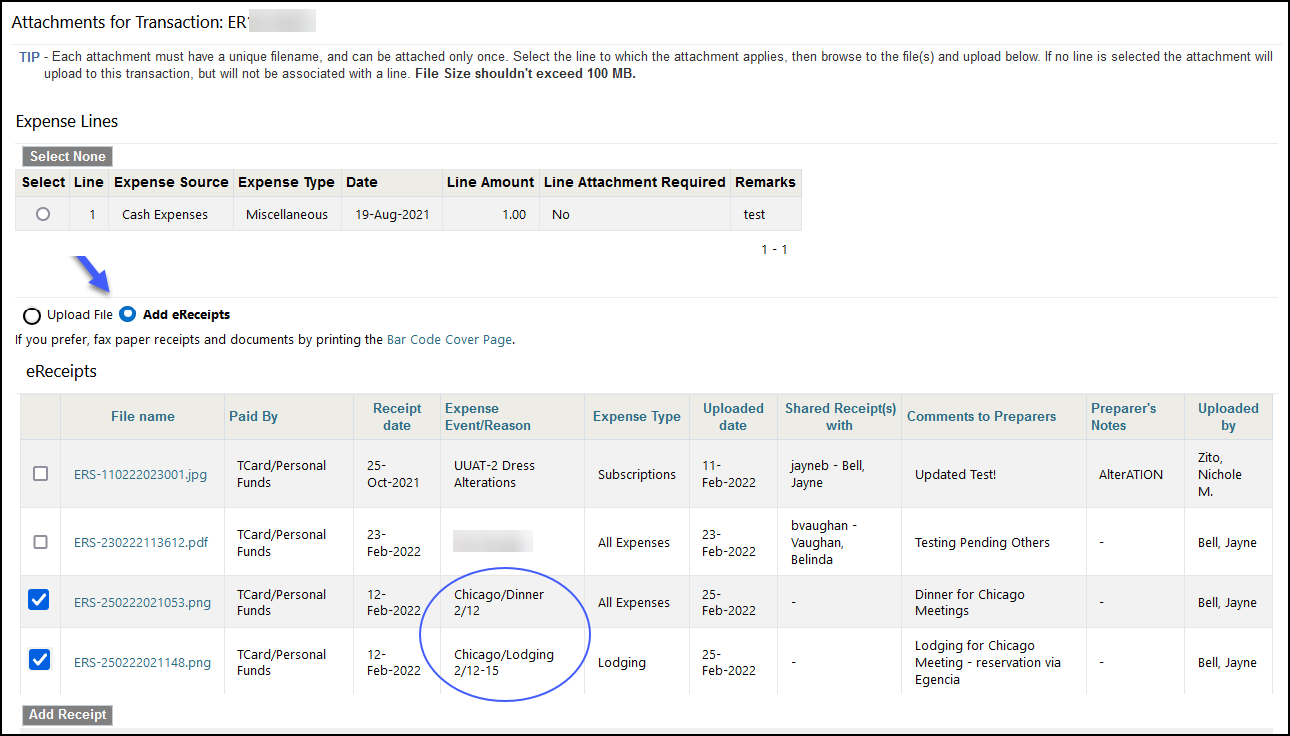

You can upload an image directly to the transaction, add attachments via the eReceipts application or fax the document using a BarCode Cover Sheet.

Expense reports must have attachments uploaded to the individual transaction line for Airfare, Lodging and Conference Registration.

- Scan or use a smartphone to photograph required receipts and documents to be attached to the transaction into a file

- Name each file with a unique name and save on the computer Allowed file formats include .pdf, .jpg, .png, .doc, .docx, .xls, .xlsx.

- Select green plus sign (if available)

- Select Browse to navigate to file

- Select file

- Select Open

- Repeat until all files for the line are in Files ready to upload

- Select Upload file(s) File(s) will appear in View Attachments.

- Select Close

- Green plus sign changes to paper clip to indicate file(s) attached

- Green plus sign changes to paper clip to indicate file(s) attached

- Scan or use a smartphone to photograph required receipts and documents to be attached to the transaction into a file

- Name each file with a unique name and save on the computer Allowed file formats include .pdf, .jpg, .png, .doc, .docx, .xls, .xlsx.

- Select Attach/View Receipts button to open the Attachments window

- Do Not select a line

- Select Browse to navigate to file

- Select file

- Select Open

- Repeat until all files are in Files ready to upload

- Select Upload file(s) File(s) will appear in View Attachments.

- Files attached to the transaction display N/A in the Expense Source and For Transaction Line(s) columns

- Select Close to close the Attachments window

Reassign Attachments to a Line (if required)

1. Click Attach/View Receipts button to open the Attachments window

2. Scroll down and select the Reassign icon for the attachment

3. Select the Document Type

4. Select the line to which the attachment is to be reassigned

5. Click Save

6. Repeat for all uploaded attachments that must be reassigned to a line

- Select Attach/View Receipts on the Transaction Review screen

- Select Add eReceipts to view all eReceipts shared with you for that Category (PCard or TCard/Personal Funds)

- Select the correct receipt(s) associated with the transaction

- Click Add Receipt button at the bottom

- Select Attach/View Receipts on the Transaction Review screen

- Select Bar Code Cover Page on the Attach/View Receipts window and print Faxed receipts and documents must include the Barcode Cover Sheet to attach to the transaction.

The fax number (650-721-3072) is on the Barcode Cover Sheet page. - Close the Bar Code Cover Page window

- Send an individual fax for each line that requires an attachment

- Send a fax containing all other receipts and documents The Bar Code Cover Page should be the first page of the Fax so that it attaches to the correct transaction.

- Select Attach/View Receipts to open the Attachments window Faxes will display in the View Attachments section, attached at the transaction level.

- Select Close to close the Attachments window

Reassign Attachments to a Line (if required)

1. Click Attach/View Receipts button to open the Attachments window

2. Scroll down and select the Reassign icon for the attachment

3. Select the Document Type

4. Select the line to which the attachment is to be reassigned

5. Click Save

6. Repeat for all uploaded attachments that must be reassigned to a line

- Review the transaction carefully for completeness, accuracy and policy compliance.

- Refer to the tabs marked Expense Lines, Expense Allocations, Approvers and Approval Notes for additional information.

- Use the Back button, if necessary, to return to previous pages for corrections.

- Attach all receipts and backup documentation (Received of Petty Cash Form) by selecting Attach View Receipts or the Attach icon for a specific expense line

- Select Submit to submit the transaction once all receipts and backup documents have been attached

Create Expense Report for Athletics (DAPER) Visitor Reimbursement

Before You Start

For Athletics Use Only

- Enter ofweb.stanford.edu in the browser

- Click Login

- As prompted, log in using SUNet ID and password

- Select SU Expense Requests

- Select Non-SU Payee under Expense Report in the Create New Transaction column

- Select Athletics Use Only Non-SU from the Category drop-down list

- Enter the Payee's name (last name, first name, or business name)

- Or search and select the payee by clicking the search icon (magnifying glass)

- Select Add New Payee to enter payee information

- Select Supplier or Visitor

- Select the radio button next to the correct Citizenship/Residence status

- Enter First Name and Last Name (Middle Name is optional)

- Select Country of Address

- Enter Address Line 1 (Address Line 2 is optional)

- Enter City

- Select State/Province if required

- Enter Postal/Zip Code if required

- Select Default Payment Method

- To request payment by check, wire or foreign draft, select Check or Wire

- To request payment by ACH/direct deposit to US bank, select Electronic

- Enter Payee /Agent Email

- Email address will auto-populate with the name of preparer if the Country of Address is outside of U.S.

- Enter payee email address if payee is a domestic visitor

- Click Apply to save new payee data Click Clear to delete all entered payee data.

The Payment Method is auto-filled based upon what the Stanford payee has set up (Electronic or Check) with Payroll. If both Electronic and Check are available for a payee (as for some DAPER staff), select preferred method from the drop down.

- Select Yes or No in the Rush Processing drop-down menu

Will Call Check > Rush Processing

Will Call check delivery option is handled via rush processing. Select Yes in the Rush Processing field. The Will Call locations will then display as the check delivery options. Select the Will Call location where the check will be picked up. A $35 processing fee will apply.

On the Allocations and Approvers page, supply a PTA to which the $35 processing fee will be charged. Some PTAs are restricted (sponsored projects) and will not allow a processing fee to be charged to them (Awards that begin with P, Q, R, S, R, U, V, W). Check with the PTA approver or the department Financial Analyst before requesting a rush processing fee. - Select a Check Delivery Option (available when the payment method is Check)

The Payment Method is auto-filled based upon what the payee has setup (Electronic or Check).

- Select Special Payment Type and Delivery Options (optional) if one of the following is desired:

- Foreign Draft

- Wire Domestic

- Wire Foreign

- Enter Business Purpose

- Review Guidelines for Writing a Clear Business Purpose to ensure the business purpose meets requirements.

- Select Event Name from the drop-down menu or, If a new event is needed, select Create New Event (refer to How To: Create New Event for details). To display the selected event details below the Event Name field, select Show Event

- Select Next

Designate PTAEs on Allocations and Approvers screen using any combination of these 3 options:

- Enter Project, Task, Award information for each line

- Select Expenditure Type for each line A commonly used expenditure type may appear. If the field is blank, select from the drop-down list.

- Select the radio button to select one, multiple or all expense lines

- Select one of the pre-set expense allocations from My Allocation drop-down list Refer to How To: Set My Allocation Preferences for more information.

- Select Apply

- Verify that the desired expenditure type has been applied to each expense line before submitting the transaction – correct as needed using the drop-down list

- To enter a new PTA (not in My Allocations) and allocate to one, multiple or all expense lines and/or

- To enter a split PTA allocation and allocate to one, multiple or all expense lines

- Select the radio button to select expense lines to be allocated

- Select Update Allocation

- Select an Allocation Method

- Mass Allocation or Single PTA

- Equal Split

- Amount Split

- Percentage Split

- Select the plus sign on table to add a new row for each PTA for a split allocation

- Enter the Project, Task, Award information (PTAs)

- Enter Amount or Percentage of split for each PTA, if necessary

- Enter Allocation Reason to describe the reason for allocation to multiple PTAs (optional) Save Allocation in My Allocation Preferences

You may save this allocation in your My Allocation Preferences for use again.

1. Select Add Allocation Set to My Allocations checkbox

2. Enter the Allocation Name - Select Apply

- Select Expenditure Type for each line A commonly used expenditure type may appear. If the field is blank, select from the drop-down list.

Designate approver(s) on Allocations and Approvers screen using any combination of these 3 options:

- Select one of the pre-set approvers from My Approvers drop-down list

- Select Apply

- Enter the approver's sequence or send in parallel (enter 1, 2, 3 for sequence; assign all approver's "1" for in parallel routing)

- Enter Notes to each approver (if needed)

- Select Next when the Approver Routing List is complete

FYI Recipients do not "approve" the expense report.

If an approver has been deleted by mistake, select Populate/Refresh to return to original default approver.

If an approver is incorrect for a PTA, please have that approver submit a Support Request to have the authority updated.

- Select Populate/Refresh to add default PTA approver(s)

Approvers that display when Populate/Refresh is selected will have the appropriate approval authority for the PTAs. If expense lines have been allocated to more than one PTA, there could be more than one approver showing in the approver routing list. - Enter the approver's sequence or send in parallel (enter 1, 2, 3 for sequence; assign all approver's "1" for in parallel routing)

- Enter Notes to each approver (if needed)

- Select Next when the Approver Routing List is complete

FYI Recipients do not "approve" the expense report.

If an approver has been deleted by mistake, select Populate/Refresh to return to original default approver.

If an approver is incorrect for a PTA, please have that approver submit a Support Request to have the authority updated.

- Select the plus sign on table to add an approver

- Select the magnifying glass icon

- Enter the approver's name (Last name, First name)

- Select Go

- Select Quick Select icon next to the approver's name

- Select Approver, FYI or Pre-Approver from Approver/FYI drop-down list

- Enter the Approval Sequence number (enter 1, 2, 3 for sequence; assign all approver's “1” for in parallel routing, assign Pre-Approvers 1).

- Enter Notes to each approver (if needed)

- Select Next when the Approver Routing List is complete

FYI Recipients and Pre-Approvers do not "approve" the expense report, but will receive notifications regarding the transaction.

If an approver has been deleted by mistake, select Populate/Refresh to return to original default approver. There must be a "Yes" displaying in the default approver column for at least one approver per PTA.

If an approver is incorrect for a PTA, please have that approver submit a Support Request to have the authority updated.

All expense reports must include receipts and other supporting documentation. If an expense has been pre-approved, supporting documentation must be obtained from the Pre-Approver and attached to the expense line or to the transaction.

An attachment for Expense Requests and PCard Transactions must be a legible copy of the entire receipt and clearly show:

- All text

- Receipt Date

- Location (when available)

- Vendor/Business Name

- Entire Receipt (Additional screenshots may be needed to include all of a lengthy receipt.

Use the Event/Reason to capture the reason and add pg. 1, pg. 2, etc. to clarify.)

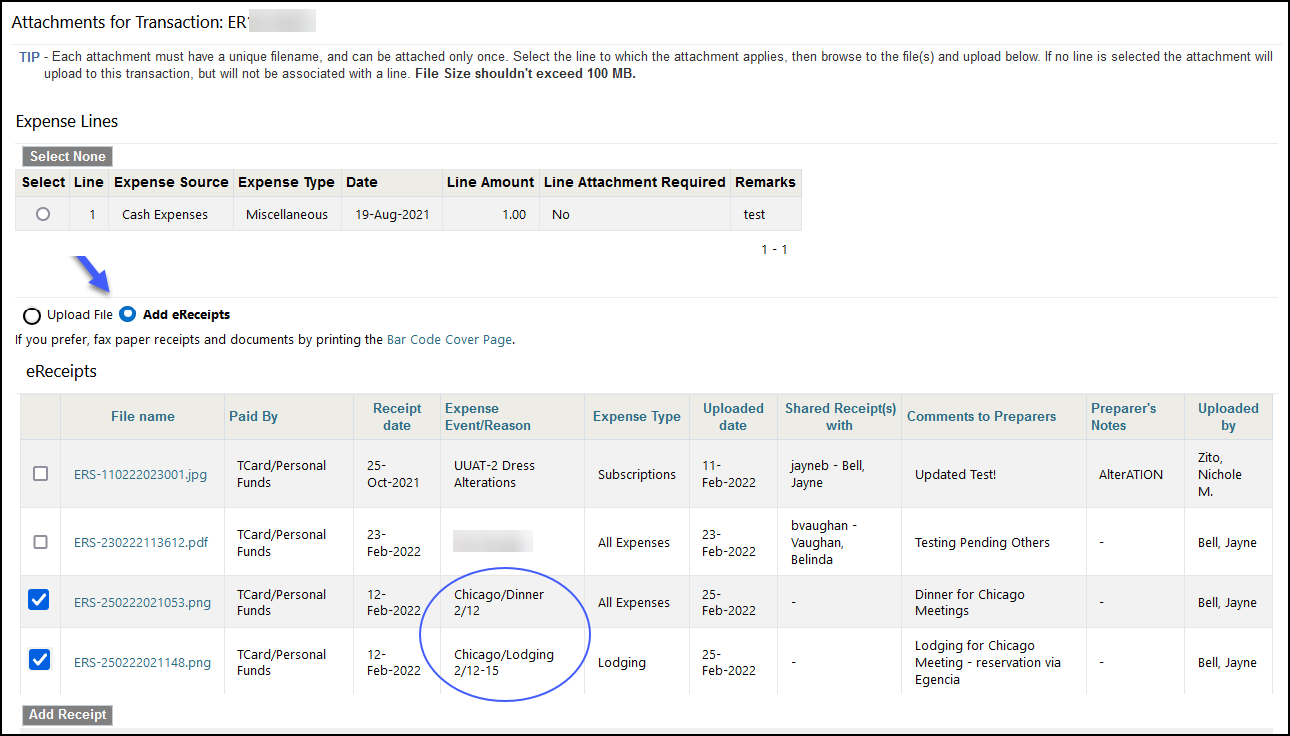

You can upload an image directly to the transaction, add attachments via the eReceipts application or fax the document using a BarCode Cover Sheet.

Expense reports must have attachments uploaded to the individual transaction line for Airfare, Lodging and Conference Registration.

- Scan or use a smartphone to photograph required receipts and documents to be attached to the transaction into a file

- Name each file with a unique name and save on the computer Allowed file formats include .pdf, .jpg, .png, .doc, .docx, .xls, .xlsx.

- Select green plus sign (if available)

- Select Browse to navigate to file

- Select file

- Select Open

- Repeat until all files for the line are in Files ready to upload

- Select Upload file(s) File(s) will appear in View Attachments.

- Select Close

- Green plus sign changes to paper clip to indicate file(s) attached

- Green plus sign changes to paper clip to indicate file(s) attached

- Scan or use a smartphone to photograph required receipts and documents to be attached to the transaction into a file

- Name each file with a unique name and save on the computer Allowed file formats include .pdf, .jpg, .png, .doc, .docx, .xls, .xlsx.

- Select Attach/View Receipts button to open the Attachments window

- Do Not select a line

- Select Browse to navigate to file

- Select file

- Select Open

- Repeat until all files are in Files ready to upload

- Select Upload file(s) File(s) will appear in View Attachments.

- Files attached to the transaction display N/A in the Expense Source and For Transaction Line(s) columns

- Select Close to close the Attachments window

Reassign Attachments to a Line (if required)

1. Click Attach/View Receipts button to open the Attachments window

2. Scroll down and select the Reassign icon for the attachment

3. Select the Document Type

4. Select the line to which the attachment is to be reassigned

5. Click Save

6. Repeat for all uploaded attachments that must be reassigned to a line

- Select Attach/View Receipts on the Transaction Review screen

- Select Add eReceipts to view all eReceipts shared with you for that Category (PCard or TCard/Personal Funds)

- Select the correct receipt(s) associated with the transaction

- Click Add Receipt button at the bottom

- Select Attach/View Receipts on the Transaction Review screen

- Select Bar Code Cover Page on the Attach/View Receipts window and print Faxed receipts and documents must include the Barcode Cover Sheet to attach to the transaction.

The fax number (650-721-3072) is on the Barcode Cover Sheet page. - Close the Bar Code Cover Page window

- Send an individual fax for each line that requires an attachment

- Send a fax containing all other receipts and documents The Bar Code Cover Page should be the first page of the Fax so that it attaches to the correct transaction.

- Select Attach/View Receipts to open the Attachments window Faxes will display in the View Attachments section, attached at the transaction level.

- Select Close to close the Attachments window

Reassign Attachments to a Line (if required)

1. Click Attach/View Receipts button to open the Attachments window

2. Scroll down and select the Reassign icon for the attachment

3. Select the Document Type

4. Select the line to which the attachment is to be reassigned

5. Click Save

6. Repeat for all uploaded attachments that must be reassigned to a line

- Review the transaction carefully for completeness, accuracy and policy compliance.

- Refer to the tabs marked Expense Lines, Expense Allocations, Approvers and Approval Notes for additional information.

- Use the Back button, if necessary, to return to previous pages for corrections.

- Attach all receipts and backup documentation (Received of Petty Cash Form) by selecting Attach View Receipts or the Attach icon for a specific expense line

- Select Submit to submit the transaction once all receipts and backup documents have been attached